How Correcting Your 2023 Tax Declaration Can Affect Your Finances ?

Discover how correcting your 2023 tax declaration in France can impact your finances. Learn about the potential tax savings, penalties, and refunds, and find out how expert guidance can help you navigate the complexities of the French tax system effectively.

Tax in France on Salary: A Comprehensive Guide for Residents and Non-Residents

This guide explains how residents and non-residents are taxed, covering income tax, social contributions, and filing tax returns. It offers practical advice for foreigners, including tips on avoiding double taxation and using online tools.

Property Tax in France: Will You Be Affected by the New Vacant Property Tax in 2024?

This article explores the latest updates on property tax in France, focusing on the expanded Vacant Property Tax (VPT) for 2024. It explains who is affected, how the tax is calculated, and important exemptions. With more municipalities now applying the VPT, many homeowners may find themselves liable for this tax on unoccupied properties. The article also highlights how ESCEC International can help property owners navigate these complex tax regulations and ensure compliance.

The Essential Role of an English Chartered Accountant in France for Expats

Expats in France face unique financial and tax challenges. Discover how an English chartered accountant in France can help you navigate complex tax laws, manage payroll, and handle financial reporting with ease. ESCEC International provides expert accounting services tailored to the needs of expats.

French SCI Entity in 2025: Understanding Your Obligations

A French SCI (Société Civile Immobilière) is a legal structure for collective property ownership. This article covers key obligations, including tax implications, reporting requirements, and the importance of bookkeeping. It highlights risks, such as potential corporation tax, and offers guidance for smooth property management in France.

Vacant Property: How to Avoid Local Taxes or Obtain a Tax Relief

This article explains how property owners can avoid or reduce local taxes on vacant properties by understanding tax exemptions, including conditions related to occupancy, uninhabitable status, and involuntary vacancies. It offers practical advice for minimizing financial burdens associated with vacant properties.

A Complete Guide to Airbnb Rentals Taxation in 2024: What You Need to Know

This article explains the 2024 tax rules for Airbnb rentals in France, covering professional and non-professional landlord statuses, tax regimes, recent changes, and how VAT and social contributions apply. It helps Airbnb hosts understand and manage their tax obligations.

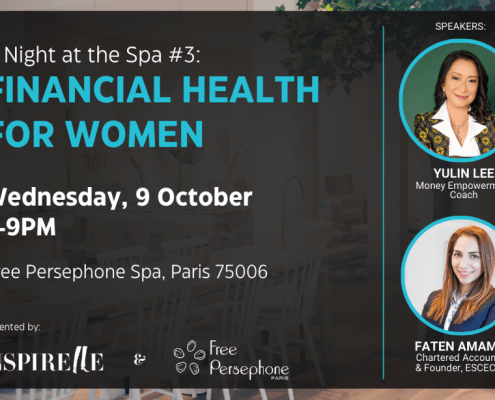

Financial Health for Women: An Event Presented by ESCEC International & Inspirelle on October 9th

Join INSPIRELLE and Free Persephone Spa on October 9 for an empowering evening focused on financial health for women. Learn from experts, ask questions, and gain the tools to take control of your finances in a supportive, relaxed setting. Reserve your spot today!

Featured on Inspirelle.com: Read Our Article on Choosing the Right Business Structure in France

Featured on Inspirelle.com, this article guides you through the key business structures in France, including auto-entrepreneur, SARL, and SAS, helping you choose the best option for your business.

Business Financing: Tax Credits and Public Aid in France

Overview of tax credits and financial aids available to businesses in France, including support for research, innovation, training, family initiatives, and specific industries like craft trades and video games.